9.2 Fields of Accounting

Accountants typically work in one of two major fields. Management accountants provide information and analysis to decision-makers inside the organization in order to help them run it. Financial accountants furnish information to individuals and groups both inside and outside the organization in order to help them assess its financial performance. Their primary focus, however, is on external parties. In other words, management accounting helps you keep your business running while financial accounting tells the outside world how well you’re running it.

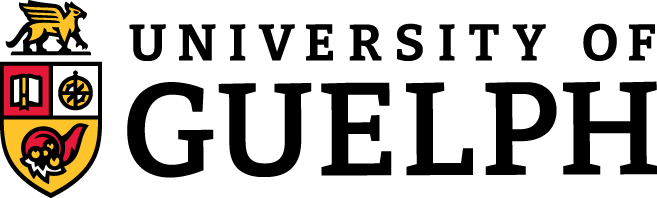

Management Accounting

Management accounting, also known as managerial accounting, plays a key role in helping managers carry out their responsibilities. Because the information that it provides is intended for use by people who perform a wide variety of jobs, the format for reporting information is flexible. Reports are tailored to the needs of individual managers, and the purpose of such reports is to supply relevant, accurate, timely information that will aid managers in making decisions. In preparing, analyzing, and communicating such information, accountants work with individuals from all the functional areas of the organization—human resources, operations, marketing, etc.

Financial Accounting

Financial accounting is responsible for preparing the organization’s financial statements—including the income statement (also called the profit/loss statement), the statement of owner’s equity, the balance sheet, and the statement of cash flows—that summarize a company’s past performance and evaluate its current financial condition. If a company is traded publicly on a stock market such as the TSX (Toronto Stock Exchange), these financial statements must be made public, which is not true of the internal reports produced by management accountants. In preparing financial statements, Canadian financial accountants adhere to a uniform set of rules called international financial reporting standards (IFRS)—the basic principles for financial reporting issued by an independent agency called the Financial Accounting Standards Board (FASB). Users want to be sure that financial statements have been prepared according to IFRS because they want to be sure that the information reported in them is accurate. They also know that when financial statements have been prepared by the same rules, they can be compared from one company to another.

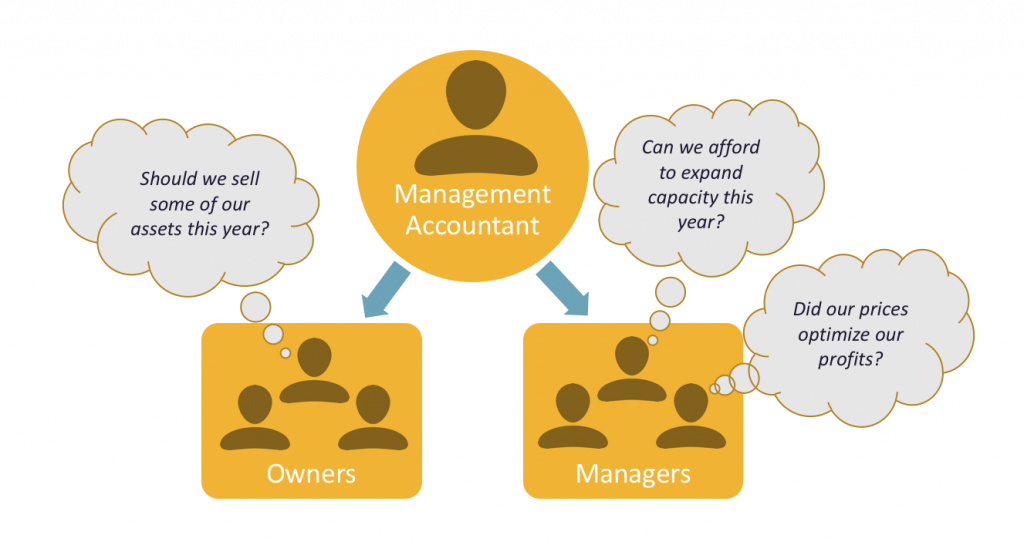

Who Uses Financial Accounting Information?

The users of managerial accounting information are pretty easy to identify—basically, they’re a firm’s managers. We need to look a little more closely, however, at the users of financial accounting information, and we also need to know a little more about what they do with the information that accountants provide them. Publicly Traded companies will provide their financial accounting information to a wider set of stakeholders, including shareholders, potential investors, etc. than compared to a privately held company that will generate a single set of financial statements according to the International Financial Reporting Standards. Publicly Traded companies will also provide their financial accounting information to the general public in order to showcase to potential investors the company’s performance. Therefore, Publicly Traded companies will typically generate two sets of financial statements, one set of detailed statements in accordance with Canadian International Financial Reporting Standards (IFRS) and another set of simplified financial statements that can be more easily consumed by the general public. For example, Tim Hortons provides access to their simplified financial statements through annual reports which can be found at https://ir.timschina.com/financials/annual-reports.

Owners and Managers

In summarizing the outcomes of a company’s financial activities over a specified period of time, financial statements are, in effect, report cards for owners and managers. They show, for example, whether the company did or didn’t make a profit and furnish other information about the firm’s financial condition. They also provide some information that managers and owners can use in order to take corrective action, though reports produced by management accountants offer a much greater level of depth.

Investors and Creditors

Investors and creditors furnish the money that a company needs to operate, and not surprisingly, they want to know how that business is performing. Because they know that it’s impossible to make smart investment and loan decisions without accurate reports on an organization’s financial health, they study financial statements to assess a company’s performance and to make decisions about continued investment.

According to the world’s most successful investor, Warren Buffett, the best way to prepare yourself to be an investor is to learn all the accounting you can. Buffett, chairman and CEO of Berkshire Hathaway, a company that invests in other companies, turned an original investment of $10,000 into a net worth of $66 billion[3] in four decades, and he did it, in large part, by paying close attention to financial accounting reports.

Government Agencies

Businesses are required to furnish financial information to a number of government agencies. Publicly-owned companies—the ones whose shares are traded on a stock exchange— for example, must provide annual financial reports to their respective provincial Securities Commission. For example, companies located in Ontario would provide financial reports to the Ontario Securities Commission (OSC), a federal agency that regulates stock trades and which is charged with ensuring that companies tell the truth with respect to their financial positions. Companies must also provide financial information to the Canadian Revenue Agency (CRA).

Other Users

A number of other external users have an interest in a company’s financial statements. Suppliers, for example, need to know if the company to which they sell their goods is having trouble paying its bills or may even be at risk of going under. Employees and labour unions are interested because salaries and other forms of compensation are dependent on an employer’s performance.

The previous figures illustrate the main users of management and financial accounting and the types of information produced by accountants in the two areas. In the rest of this chapter, we’ll learn how to prepare a set of financial statements and how to interpret them. We’ll also discuss issues of ethics in the accounting communities and career opportunities in the accounting profession.